The Role of Money in the Economy and the Implications of a Cashless Society

Introduction

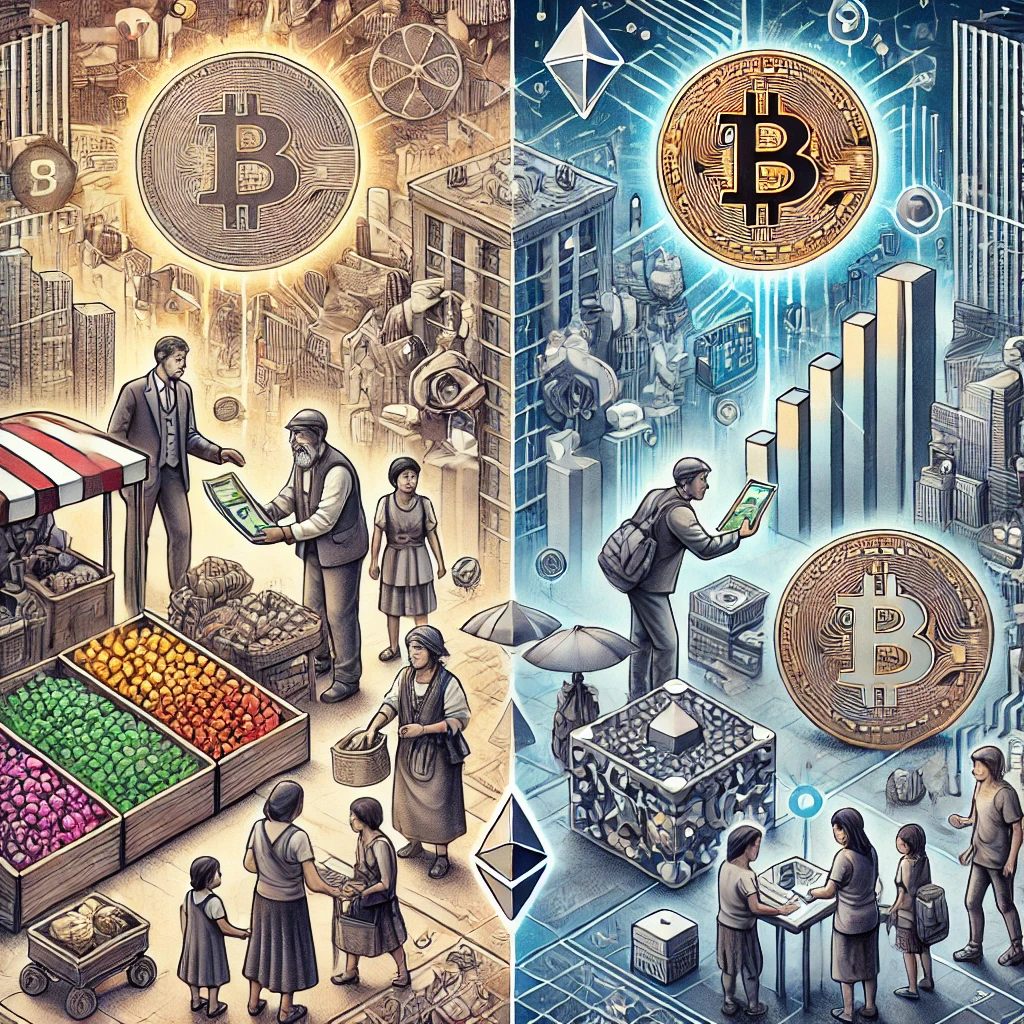

Money serves as the lifeblood of modern economies, functioning as a medium of exchange, a unit of account, a store of value, and a standard of deferred payment (Mankiw, 2019). Throughout history, the forms of money have evolved from barter systems to commodity money, and ultimately to fiat money. Recently, there has been a significant push towards a cashless society, driven by advancements in digital technology and the emergence of Central Bank Digital Currencies (CBDCs). While these innovations promise efficiency and convenience, they also pose risks, particularly for marginalized communities. Additionally, cryptocurrencies like Bitcoin and Ethereum offer an alternative to traditional financial systems, presenting a more decentralized and potentially equitable financial ecosystem.

The Functions of Money

Money facilitates economic transactions by eliminating the inefficiencies of barter systems, providing a common measure of value, and enabling the accumulation and preservation of wealth. It also plays a critical role in economic stability and growth, influencing inflation, interest rates, and overall economic activity (Mankiw, 2019).

The Transition to a Cashless Society

Advantages and Disadvantages

The transition to a cashless society, characterized by the widespread use of digital payments and CBDCs, offers several advantages. These include reduced costs associated with printing and handling physical money, enhanced transaction speed, improved tax compliance, and increased convenience for consumers (Bordo & Levin, 2017). However, this shift also has significant drawbacks, especially for vulnerable populations.

Impact on Vulnerable Populations

Cash transactions retain their value through every exchange, whereas digital payments often incur transaction fees that gradually erode the value of the money. For instance, R50 cash remains R50 even after 20 transactions. In contrast, R50 paid in digital payments can be significantly reduced due to cumulative transaction fees, potentially transferring the entire amount to financial institutions over multiple transactions (Schweitzer, 2017). This erosion disproportionately affects low-income individuals who rely on small transactions for daily necessities, further marginalizing them in an increasingly digital economy.

Cryptocurrencies: A Decentralized Alternative

Cryptocurrencies like Bitcoin and Ethereum have emerged as a decentralized alternative to traditional fiat currencies. These digital assets operate on blockchain technology, offering transparency, security, and resistance to censorship (Nakamoto, 2008).

Decentralization and Financial Inclusion

Unlike fiat currencies controlled by central banks, cryptocurrencies are decentralized and operate on a peer-to-peer network. This decentralization can democratize financial access, allowing individuals without traditional banking services to participate in the global economy (Narayanan et al., 2016). Moreover, cryptocurrencies can offer lower transaction fees compared to traditional banking systems, preserving the value of money across transactions.

Challenges and Opportunities

Despite their potential, cryptocurrencies also face challenges, including regulatory uncertainty, volatility, and scalability issues. However, ongoing technological advancements and increasing adoption suggest that cryptocurrencies could play a significant role in shaping a more inclusive and equitable financial future (Böhme et al., 2015).

Conclusion

The role of money in the economy is fundamental, facilitating trade, preserving wealth, and enabling economic growth. While the transition to a cashless society and the implementation of CBDCs offer efficiency and convenience, they also risk marginalizing vulnerable populations by eroding the value of digital payments through transaction fees. In contrast, cryptocurrencies present a decentralized and potentially more equitable financial ecosystem. As the global financial landscape continues to evolve, it is crucial to consider the impacts on all members of society and strive towards a system that promotes inclusivity and equity.

References

Böhme, R., Christin, N., Edelman, B., & Moore, T. (2015). Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives, 29(2), 213-238.

Bordo, M. D., & Levin, A. T. (2017). Central bank digital currency and the future of monetary policy. National Bureau of Economic Research.

Mankiw, N. G. (2019). Principles of Economics (9th ed.). Cengage Learning.

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system. Retrieved from https://bitcoin.org/bitcoin.pdf

Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies. Princeton University Press.

Schweitzer, M. E. (2017). The impact of transaction fees on the value of money: Evidence from a digital payment system. Journal of Financial Services Research, 52(1-2), 49-72.